UK firms that export to the EU are ‘being told to set up hubs across the Channel’ to help avoid post-Brexit trade disruption

- Bosses of firms claim they have been advised to set up subsidiaries in Europe

- One company chief told BBC he needed £140 certificate to export £30 gift box

- He claims UK food officials said best option was to set-up an EU packaging firm

- Fashion firm boss told BBC she was advised to link up with German warehouse

- Department for International Trade says such advice is ‘not Government policy’

UK businesses that export to the EU are reportedly being encouraged by trade officials to set up hubs across the Channel so they can avoid post-Brexit disruption.

Some firms claim they have been advised to set up subsidiary companies in the EU so they can avoid extra paperwork when exporting products into the trade bloc.

One boss of a UK cheese producing company told the BBC he was advised to set-up in Europe to avoid disruption to his EU exports.

Another, the boss of a clothing firm, told the BBC that they had been encouraged to link up with a distribution centre Germany in order to keep exporting to the EU.

It comes after fashion industry experts warned High Street retailers and luxury brands may burn items returned by customers that are now stuck in European warehouses rather than bringing them back to the UK to avoid the cost and hassle of red tape.

The Department for International Trade told MailOnline it was ‘not government policy’ to advise businesses to set-up subsidiaries abroad.

However, co-founder of Macclesfield-based Cheshire Cheese Company, Simon Spurrell, was one of those who claimed he had been told to set up shop in the EU.

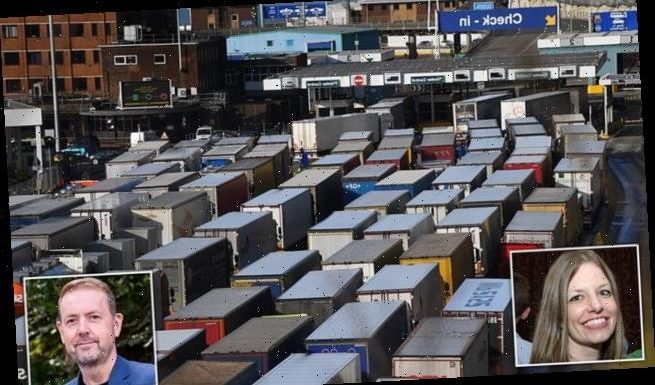

Some firms claim they have been advised to set up subsidiary companies in the EU so they can avoid extra paperwork when exporting products into the trade bloc. Pictured: Lorries quieing-up at the Port of Dover on Friday

Co-founder of Macclesfield-based Cheshire Cheese Company, Simon Spurrell (pictured left), was one of those who claimed he had been told to set up shop in the EU. Ulla Vitting Richards (pictured right), told the BBC she had been advised to move her stock to a warehouse in Germany in order to keep exporting to the EU

Mr Spurrell reportedly approached the Department for Environment, Food and Rural Affairs for advice over the need for a veterinary-approved health certificates for exports.

The firm was reportedly being asked to pay £180 for the certificates to export gift boxes costing up to £30 each.

What are the extra charges and paperwork and why were they introduced?

Shipping goods either way across the UK-EU border now takes longer and is more expensive since the UK left the EU’s Customs Union and Single Market.

Since January 1 a new customs regime has been in place that treats the UK as an external ‘third country’ for goods being imported and exported into and out of the EU.

Although the terms of the free trade deal mean there are no tariffs or quotas, the small print of the deal imposes new red tape and charges for goods being moved across the border.

Customs clearance charges must now be paid, while many couriers also add on postal or handling fees to account for the extra paperwork they now need to process.

VAT is payable by businesses when they bring goods into the UK. Goods that are exported by UK businesses to the EU are zero-rated, meaning that UK VAT is not charged at the point of sale.

Some goods may need a rules of origin document.

And once they arrive at the ports, there are new checks by officials which also slow down the transport process.

The extra time taken for goods to cross the border means some shipments have been delayed.

That means that in addition to extra fees at the border goods are also taking longer to travel from retailer to customer – complicating the situation further.

He told the BBC he had been advised to set up a packaging firm across the Channel.

Mr Spurrell said: ‘They told me setting up a fulfilment centre in the EU where we could pack the boxes was my only solution.’

He added that the business was now looking to ‘test the water’ with a business in France, but it had scrapped plans to build a new £1million warehouse in the UK – which he said could have created up to 30 jobs.

Another business owner, Ulla Vitting Richards, told the BBC she had been advised to move her stock to a warehouse in Germany in order to keep exporting to the EU.

Ms Richards, who runs UK-based sustainable fashion firm Vildnis, told the BBC: ‘(The official from the Department of Trade) told me we’d be best off moving stock to a warehouse in Germany and get them to handle it.’

She says she has stopped exporting to the EU since Brexit.

It comes as it was revealed earlier this week UK Fashion & Textile Association chief Adam Mansell said retailers may now find it cheaper to simply dispose of the items at the EU warehouses rather than pay to have them shipped back to Britain.

He said: ‘It’s part of the ongoing small print of the deal. If you’re in Germany and buying goods from the UK, you as the German customer are the importer bringing goods into the EU.

‘You then have a courier company knocking on the door giving you a customs clearance invoice that you need to pay to receive your goods.’

Mr Mansell said further customs paperwork facing UK retailers when goods are returned includes an ‘export clearance charge, import charge arrival, import VAT charge and, depending on the goods, a rules of origin document as well. Lots of large businesses don’t have a handle on it, never mind smaller ones.’

Following Britain’s exit from the Customs Union and Single Market, EU consumers buying a coat, a pair of boots or any other product from a UK-based retailer now have to pay charges including import duties and courier or postal handling fees.

Some of the same costs and red tape also apply to British customers buying products that have been shipped from the EU – adding a third to the cost of online orders and slowing down deliveries due to extra checks at ports.

Customers in the EU are being asked to pay the extra costs by couriers when the goods reach their door, so many are rejecting them to avoid paying the bill. Figures from data firm Statista show that 30% of orders are now being returned.

UK Fashion & Textile Association chief Adam Mansell said it was often cheaper for British retailers to dump goods being returned from Europe rather than deal with them

Clothes shopper Louisa Walters, 52, was asked for £77.23 in tax, duties and charges after splashing out more than £240 on two items of clothing from Paris-based Sandro

How delays at the border are hitting food deliveries

There are more forms to fill in before lorries arrive at the Channel and other crossings following the UK’s exit from the Customs Union and Single Market.

And once they arrive at the ports, there are new checks by officials which also slow down the transport process.

For UK retailers, it means there is a slowdown in receiving stock from the EU. It takes longer for European hauliers to get here, and UK-based lorries are slowed down on the way out and then slowed down on the return trip as well.

This is leading to empty shelves and shortages of some goods for consumers.

The most immediate problems are with perishable goods – food and drink. Alcoholic drinks and staples including broccoli, tomatoes and cheese have been in short supply because they are imported from manufacturers in Europe.

The problems are similar for exporters, UK firms sending goods to be sold in Europe.

The import problem is most acute for perishable foods. Fish and shellfish that are sold to European markets are decomposing in the back of lorries because of the time taken to get across. And now the problem is affecting other, more robust foods, like meat and vegetables, which are rotting on the dockside.

Scottish seafood firms last week warned they are just ‘days from collapse’ unless emergency cash is paid out to compensate for the Brexit border chaos.

Hauliers have also faced difficulties transporting stock to Ulster under the Northern Ireland Protocol in the Brexit deal.

The protocol is designed to allow Northern Ireland to follow the EU’s customs rules to prevent the establishment of a hard border on the island of Ireland.

But this has caused delays at the ports on either side of the Irish Sea because of new declarations and checks.

Four major UK High Street fashion retailers are have begun stockpiling returns at warehouses in Belgium, Ireland and Germany, reported the BBC. One brand will incur charges of almost £20,000 to get the returns back.

Apart from the charges, businesses need to also complete Customs declaration forms detailing the contents, their origin and value to get goods through ports.

British shoppers have already complained about being hit with punishing ‘Brexit fees’ on purchases from Europe, which could add more than third to the cost of a new outfit.

Londoner, Ellie Huddleston, aged 26, found the charges added up to £82 for a £200 coat and another £58 for a selection of blouses that had a list price of £180.

Lisa Walpole, from Norfolk, was told to pay £121 in relation to a £236 clothes order she made from the Norwegian website Onepiece.com, which specialises in premium jumpsuits.

And Helen Kara, from Uttoxeter in Staffordshire, was hit with a bill for £93 after purchasing £292 worth of bed linen from Urbanara.co.uk, which is based in Berlin.

Ms Huddleston said she was surprised by the fees, which were notified by the two international courier firms who were handling the shipments.

‘I didn’t even know when the parcels would be coming – so I sent both back without paying the extra fees and won’t be ordering anything from Europe again any time soon,’ she told the BBC.

One of the biggest problems is that people shopping with an EU-based store online find it difficult, if not impossible, to understand how much the extra charges will add up to.

A man who paid £300 to buy two pairs of suede winter boots from a German firm online was told by UPS that he would have to come up with another £147 before they would deliver.

The unnamed man told the BBC: ‘It was virtually impossible to find out what the charges would be beforehand, so I had to take a shot in the dark. I didn’t imagine that it would be half as much again.’

Under the new rules, anyone in the UK receiving a gift from the EU worth more than £39 may now face a bill for import VAT – with many items charged at 20per cent.

For goods costing more than £135, customs duties may also apply, which can range from 0-25per cent of the purchase price.

The extra charges are usually collected by the courier on behalf of the government, with customers asked to pay before they can pick up their package. Because of the new red tape and costs involved, most courier firms add a handling fee, so pushing up the bill even more.

The Brexit trade deal has seen many European customers rejecting goods imported from the UK after being presented with unexpected customs paperwork and charges when signing for them

The costs and complexity of the new regime means that some EU businesses have decided to suspend selling items to UK consumers.

Courier industry expert, David Jinks, the Head of Consumer Research at ParcelHero, said: ‘Now the UK has left the EU’s single market I’m afraid shoppers buying from EU stores should expect the unexpected.

‘Despite the fact Boris Johnson claimed he had secured a ‘cakeist’ free trade deal, meaning Britain can actually have its cake and eat it, there are, in fact, a bunch of new fees that may need to be paid on parcels arriving from the EU.

‘Some EU-based stores have stopped selling to the UK entirely because of the mess.’

The Government said: ‘We have encouraged companies new to dealing with customs declarations to appoint a specialist to deal with import and export declarations on their behalf – and we made more than £80m available to expand the capacity of the customs agents market.

‘The Government will continue to work closely with businesses to ensure they are able to trade effectively under the new rules.’

Meanwhile, on claims UK businesses were being told to create subsidaries in the EU, a Department for International Trade spokesperson said: ‘This is not government policy, the Cabinet Office have issued clear guidance, available at gov.uk/transition, and we encourage all businesses to follow that guidance.

‘We are ensuring all officials are properly conveying this information.’

British customers are also liable to be hit with further duties if the goods originated, even partially, outside the EU.

The delivery companies are then whacking their own additional charges on top – 2.5 per cent of the VAT charge in the case of DHL – to cover their administrative fees.

It is believed that the issues can be ironed out over the next few months as more EU retailers register with HMRC.

These are four examples of products ordered by UK customers from EU firms that have now gone up in price due to Brexit charges and red tape

Lisa Walpole, from Norfolk, was told to pay £121 in relation to a £236 clothes order she made from the Norwegian website Onepiece.com, which specialises in premium jumpsuits

And Helen Kara, from Uttoxeter in Staffordshire, was hit with a bill for £93 after purchasing £292 worth of bed linen from Urbanara.co.uk, which is based in Berlin (pictured is the firm’s website)

But some have pulled the plug on their UK operations altogether in the wake of Brexit.

Shoppers in the UK have reported shortages of some items in domestic supermarkets after Britain split from Brussels at the start of the year.

Items seemingly in short supply have included cauliflower packs, citrus fruit, courgettes, French wine and brie.

Meanwhile, M&S stores in France have faced supply issues and millions of pounds worth of meat exports from the UK have been left to rot in ports on the continent because of new border rules.

Northern Ireland has also experienced food shortages but ministers have previously been insistent problems were not Brexit-related.

Northern Ireland Minister Brandon Lewis said empty shelves had ‘nothing to do with leaving the EU’ as he blamed the coronavirus crisis.

But Ms Truss, the International Trade Secretary, has now said Brexit is partly to blame, putting her at odds with her Cabinet colleague.

She told ITV’s Peston programme: ‘Well, I think it is down to both of those issues. Of course we were always clear that we are leaving the single market, we are leaving the customs unions, there would be processes to be undertaken.

‘We are now seeing a more rapid flow of goods into Northern Ireland and those supermarket shelves are being stocked.

‘Of course there was always going to be a period of adjustment for businesses but at the same time the benefits of having the trade deal we now have with the EU is we are able to strike trade deals with the rest of the world.’

But while some sectors have shared their post-Brexit difficulties, others, such as the boss of car-making giant Nissan, says the UK’s new trade deal with the US gives the country a ‘competitive advantage’.

Ashwani Gupta, the carmaker’s chief operating officer, said he believed the last minute deal would ‘redefine’ the UK’s auto industry.

Ashwani Gupta (pictured), the carmaker’s chief operating officer, said he believed the last minute deal would ‘redefine’ the UK’s auto industry

The Brexit trade deal has given Nissan a competitive advantage, according to a senior official at the Japanese car giant. Pictured: The plant today

‘Brexit has brought the business continuity in the short-term, protects 75,000 jobs across Europe and most importantly – all of our models which we manufacture in Sunderland,’ he told a news briefing.

Speaking from Japan, he said Nissan would continue investing in the UK, stressing the company did not stop investing in the run-up to the UK leaving the EU.

The Brexit deal had secured the sustainability of Nissan and improved competitiveness of the giant Sunderland factory, he said.

‘Sunderland is one of the top three plants in the world for competitiveness for Nissan,’ he said. ‘Brexit gives us the competitive advantage in the UK and outside.’

Mr Gupta also said Nissan would move production of the batteries used in its Leaf electric cars to the UK to take advantage of trade rules guaranteeing zero tariffs on EU exports if at least 55 per cent of the car’s value is derived from the UK or the EU.

The batteries are currently imported from Japan, but Mr Gupta told the BBC: ‘We’ve decided to localise the manufacture of the 62KW battery in Sunderland so that all our products qualify (for tariff-free export to the EU).’

By the end of 2023 all Nissan cars sold in Europe will have an electrified version, he said, adding it would then be up to customers to decide how quickly they switch from petrol and diesel motors.

Mr Gupta added Nissan’s message had been ‘consistent’ over the past few years, while Brexit was causing so much uncertainty for business.

‘As long as the current business conditions are kept, we are sustainable, not only in Sunderland, but across Europe.’

Business Secretary Kwasi Kwarteng said: ‘Nissan’s decision represents a genuine belief in Britain and a huge vote of confidence in our economy thanks to the vital certainty that our trade deal with the EU has given the auto sector.

‘For the dedicated and highly-skilled workforce in Sunderland, it means the city will be home to Nissan’s latest models for years to come and positions the company to capitalise on the wealth of benefits that will flow from electric vehicle production as part of our green industrial revolution.’

Source: Read Full Article